Stock markets continued to move upwards as fund inflows and higher volumes indicate renewed demand for equities. While guidance and earnings expectations were lowered for this past quarter, many companies still managed to beat analysts earnings lowered expectations. Many financial companies, including Goldman Sachs (GS) and JPMorgan (JPM), reported strong revenue increases in the fourth quarter of 2012. As we crossed above 1500 on the S&P 500, we saw some individual company shares continue to climb. We can expect some profit taking and selling after some company earnings reports are released. Of the indicators mentioned in previous articles, it is notable that the Arms Index (SPXA50R) crossed above 90 on 22 January 2013. It is rare for the Arms Index to stay above that 90 level for long, though reaching that level is not necessarily an indicator that stock markets have peaked and are about to decline. The 30 year US Treasury yield has climbed above 3.0%, though the 10 year US Treasury remains in demand with a yield still well under 2.0%. The Volatility Index (VIX), and the corresponding S&P 100 Volatility Index (VXO), which gives us an indication of risk perception of the 100 largest companies on the S&P Index, hit record low levels normally associated with boom times. While it is difficult to claim we are near a peak in the current rally, it is also difficult to see much more upside in stock markets. As we continue through earnings season, watch for adverse market reactions to earnings reports. While Apple (AAPL) is more a measure of consumer spending than they are of the overall economy, a lower guidance from the company after reporting earnings on 23 January 2013 sent shares tumbling in after-hours trading.

One of the more unusual trends we have seen more of lately is an increase in the relative volume of Japanese Yen (JPY) in global currency markets. It is tough to know exact trading volumes, though there appears to be a substantial increase recently in Japanese Yen being converted to other currencies. Some of that has been towards US Dollars (USD), often exceeding the volume of Euros (EUR) being converted to US Dollars. One of the correlation pairs amongst carry trade movements is the Euro to Yen (EUR/JPY) trading pair. When commodities activity had a larger sway on global stock markets, the Australian Dollar (AUD) movement relative to the US Dollar (AUD/USD) held a good correlation to the S&P 500 movement. The difference lately has come from Japan, who for years issued more debt than any other developed nation. Debt to GDP in Japan is now over 230%. Compared to Greece at near 165% Debt-to-GDP, this appears to be a serious problem. Japanese people hold a far larger percentage of this debt compared to the debt holdings of any other developed country, indicating confidence in the Japanese government. Demand for Japanese debt has remained high over the last several years, which fuelled demand for Yen. The other odd factor was the central bank discount window, which allows certain investors a very high leverage after short term borrowing in Japanese Yen. About one fourth of the current Japanese budget goes solely towards payment on previously issued debt. Newly elected Prime Minister Shinzo Abe is now pushing for new infrastructure spending and ¥20.2 trillion (Yen) stimulus. Over the last few years, a strong JPY has hurt Japanese exports, so a weaker Yen might stimulate export markets. Now with new central bank stimulus, and a 2% inflation target, the Yen is falling relative to other currencies. The most likely mechanism is for the Bank of Japan to directly initiateasset purchases, including Yen denominated government and corporate bonds. There has been some grumbling about this in Europe and the United States, though with the levels of stimulus already active in those regions, we now find a global race to devalue currencies. The head of the International Monetary Fund (IMF) Christine Lagarde is unconvinced that new Japanese stimulus and inflation targets will have much of any affect beyond the near term, and does not support active currency devaluation efforts. In the short term this may work, and we can watch EUR/JPY movements to gauge some of the effectiveness. Of course with major central banks now buying sovereign debt, and throwing around money through various stimulus measures, the bond markets have been somewhat unattractive for finding yield. The one exception of note is US Treasury Inflation Protected Securities (TIPS) which continue to see high demand. The latest TIPS auction saw $15 billion of bids, pushing yields to a (negative) -0.630% for 10 year TIPS. This is an indication that expectations of inflation in the United States over the next ten years is still high. Given this rush for devaluation, it should be little surprise that funds are now flowing more into equities than bonds.

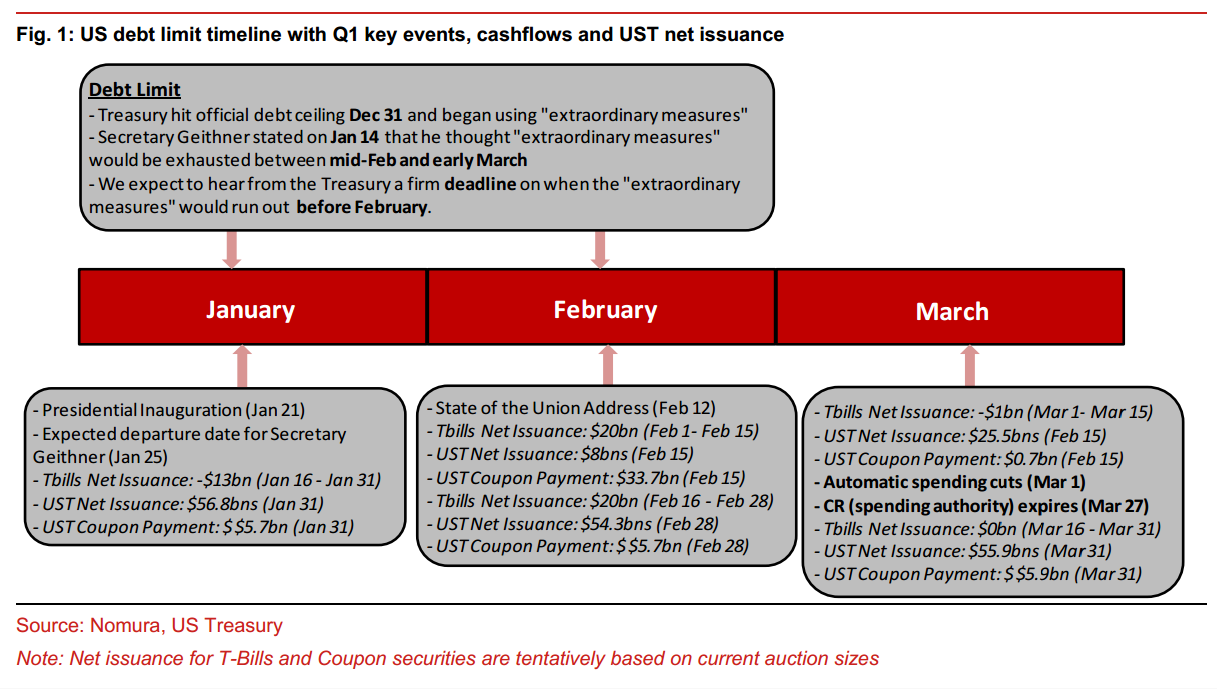

One of the more unusual trends we have seen more of lately is an increase in the relative volume of Japanese Yen (JPY) in global currency markets. It is tough to know exact trading volumes, though there appears to be a substantial increase recently in Japanese Yen being converted to other currencies. Some of that has been towards US Dollars (USD), often exceeding the volume of Euros (EUR) being converted to US Dollars. One of the correlation pairs amongst carry trade movements is the Euro to Yen (EUR/JPY) trading pair. When commodities activity had a larger sway on global stock markets, the Australian Dollar (AUD) movement relative to the US Dollar (AUD/USD) held a good correlation to the S&P 500 movement. The difference lately has come from Japan, who for years issued more debt than any other developed nation. Debt to GDP in Japan is now over 230%. Compared to Greece at near 165% Debt-to-GDP, this appears to be a serious problem. Japanese people hold a far larger percentage of this debt compared to the debt holdings of any other developed country, indicating confidence in the Japanese government. Demand for Japanese debt has remained high over the last several years, which fuelled demand for Yen. The other odd factor was the central bank discount window, which allows certain investors a very high leverage after short term borrowing in Japanese Yen. About one fourth of the current Japanese budget goes solely towards payment on previously issued debt. Newly elected Prime Minister Shinzo Abe is now pushing for new infrastructure spending and ¥20.2 trillion (Yen) stimulus. Over the last few years, a strong JPY has hurt Japanese exports, so a weaker Yen might stimulate export markets. Now with new central bank stimulus, and a 2% inflation target, the Yen is falling relative to other currencies. The most likely mechanism is for the Bank of Japan to directly initiateasset purchases, including Yen denominated government and corporate bonds. There has been some grumbling about this in Europe and the United States, though with the levels of stimulus already active in those regions, we now find a global race to devalue currencies. The head of the International Monetary Fund (IMF) Christine Lagarde is unconvinced that new Japanese stimulus and inflation targets will have much of any affect beyond the near term, and does not support active currency devaluation efforts. In the short term this may work, and we can watch EUR/JPY movements to gauge some of the effectiveness. Of course with major central banks now buying sovereign debt, and throwing around money through various stimulus measures, the bond markets have been somewhat unattractive for finding yield. The one exception of note is US Treasury Inflation Protected Securities (TIPS) which continue to see high demand. The latest TIPS auction saw $15 billion of bids, pushing yields to a (negative) -0.630% for 10 year TIPS. This is an indication that expectations of inflation in the United States over the next ten years is still high. Given this rush for devaluation, it should be little surprise that funds are now flowing more into equities than bonds. One of the events many investors have been watching is the Debt Ceiling. In an unusual move in Congress, the House of Representatives voted 285 to 144 to passed a bill to allow the Federal Government to continue borrowing through 19 May 2013. The Senate expects to pass this same bill soon. One of the provisions in this bill is a mandate for politicians to pass a budget by 15 April 2013, or face a suspension of their pay in the event they fail to meet that deadline. It's an unusual idea originally proposed around November elections, though it is more symbolic than an actual deterrent. Instead of attaching spending cuts to this bill, it is now expected that the spending cuts delayed from the beginning of this year will become the next battle on 1 March 2013. If no proposals are put forward before then, automatic spending cuts will be triggered for the military budget, funding of some Federal agencies, and cuts to some domestic spending programs. So far Fitch Ratings has indicated that automatic spending cuts on 1 March 2013 would not trigger a cut of the credit rating of the United States. Considering the self-imposed 15 April budget deadline, some of those cuts may not be in place for long. A temporary funding bill for some government agencies is set to expire on 27 March 2013, and it is unlikely that will be addressed prior to the budget deadline. With the national debt now at $16.4 trillion, this short term extension does nothing to put the United States on a path to fiscal sustainability. The United States has not defaulted on payments on US Treasuries since 1979, which was caused by politicians failing to meet a deadline at that time. Even the prospect of withholding the pay of politicians could become a hollow provision, since the House of Representatives and the Senate only need to pass their own proposals to comply, and there is no aspect of that provision requiring both houses of Congress to pass the same budget proposal. It is tough to see where any compromise may occur, and we still face a prospect of more extensions, temporary measures, and kicking the can down the road. The outcome of negotiations around these deadlines will prompt some uncertainty in financial markets, though for now politicians have temporarily moved out of the way.

One of the events many investors have been watching is the Debt Ceiling. In an unusual move in Congress, the House of Representatives voted 285 to 144 to passed a bill to allow the Federal Government to continue borrowing through 19 May 2013. The Senate expects to pass this same bill soon. One of the provisions in this bill is a mandate for politicians to pass a budget by 15 April 2013, or face a suspension of their pay in the event they fail to meet that deadline. It's an unusual idea originally proposed around November elections, though it is more symbolic than an actual deterrent. Instead of attaching spending cuts to this bill, it is now expected that the spending cuts delayed from the beginning of this year will become the next battle on 1 March 2013. If no proposals are put forward before then, automatic spending cuts will be triggered for the military budget, funding of some Federal agencies, and cuts to some domestic spending programs. So far Fitch Ratings has indicated that automatic spending cuts on 1 March 2013 would not trigger a cut of the credit rating of the United States. Considering the self-imposed 15 April budget deadline, some of those cuts may not be in place for long. A temporary funding bill for some government agencies is set to expire on 27 March 2013, and it is unlikely that will be addressed prior to the budget deadline. With the national debt now at $16.4 trillion, this short term extension does nothing to put the United States on a path to fiscal sustainability. The United States has not defaulted on payments on US Treasuries since 1979, which was caused by politicians failing to meet a deadline at that time. Even the prospect of withholding the pay of politicians could become a hollow provision, since the House of Representatives and the Senate only need to pass their own proposals to comply, and there is no aspect of that provision requiring both houses of Congress to pass the same budget proposal. It is tough to see where any compromise may occur, and we still face a prospect of more extensions, temporary measures, and kicking the can down the road. The outcome of negotiations around these deadlines will prompt some uncertainty in financial markets, though for now politicians have temporarily moved out of the way.Economic conditions continue to improve in the United States. Despite uncertainty around the Fiscal Cliff and Debt Ceiling, it appears that businesses and consumers recently increased spending. Economic indicators are still mixed and muted, with the recent index of consumer sentiment falling to 71.3 in December 2012, the lowest reading since December 2011. The consumer price index (CPI) came in at 1.7% in December 2012 on a year to year basis, against an expectation of 1.8% CPI. Sales of toys rebounded to top $5 billion in 2012 for the first time in three years. Rising inventories of oil and natural gas have now begun to curtail some drilling activity, as a potential oversupply would adversely lower prices. While lower oil prices would help consumers, it makes it more difficult for oil companies to continue some drilling operations, since drilling activity is mainly planned by profit potential and efficiency considerations. On an investment basis, reduced drilling activity is more likely to affect rig companies and oil services companies in the United States, as the oil majors reduce spending in the US. The Bureau of Labor Statistics released December 2012 Employment data that indicated the unemployment rate remained little changed at 7.8%. The greatest improvement in employment was in New York, while the greatest decline in employment was in California. The West continues to experience the highest unemployment rates at an average of 8.6% with the Pacific region as high as 9.2% on average. The largest year over year jobs increase occurred in Texas at 260,800 jobs added. Manufacturing continues to slowly improve with the latest Markit Research Manufacturing Purchasing Managers Index (Markit PMI) showing 56.1 against 53.0 expectations. Initial jobless claims reached 330k against 355k expected, though it should be noted that it appears the state of California did not file a report with the Labor Department. In the latest Federal Reserve Beige Book report, it is noted that all twelve districts showed increases in consumer spending at a moderate pace. Business and international travel increased tourism activity, helped by early snowfall in some parts of the United States. Manufacturing remains mixed, though transportation services saw increased volumes in six districts. Trends in wages, prices, and employment were relatively unchanged. Residential real estate activity expanded across all districts, though non-residential construction declined and demand for commercial real estate loans appears to be slowing.

In the latest data release from the National Association of Home Builders (NAHB), sentiment amongst builders has increased slightly, to the highest levels since April 2006. The NAHB note that persistently tight mortgage credit conditions, and difficulties in obtaining appraisals continue to drag on builder confidence. The NAHB Housing Market Index only considers single family dwellings, and a reading over 50 would indicate good outlook. The latest NAHB Indexreading is 47 against 48 expected by analysts. Part of the reason for home price increases has been a 17% decline in available inventory in 2012. The Mortgage Bankers Association note that mortgage applications increased 15.2 percent for the week ending 11 January 2013. Refinance activity remains at 82% of total applications. December 2012 existing home sales declined to 4.94 million against 5.10 million expected. Investor activity in housing markets has also been strong, though much tougher to track in available information. In a recent note to investors, Blackstone Group reported that they were spending about $100 million a week on purchasing houses for use as rental properties, largely through foreclosure sales and short sales. Along with Colony Capital LLC and Two Harbors Investment Corporation, Blackstone Group are creating a new asset management investment class, in an area previously dominated by small investors. This is a market that analysts at JPMorgan predict could be worth as much as $1.5 Trillion in the near future. The only point of concern is that these large private equity companies might crowd out more traditional mom and pop investors, or that they may artificially affect price levels of some real estate. The good news in this is that while the housing market is still below historical levels, we have seen continued improvements over the last three years. Housing is no longer a drag on the US economy. Even new housing starts and filings of building permits increased in late 2012. These improvements should allow housing to contribute to GDP growth in the United States in 2013.

In the latest data release from the National Association of Home Builders (NAHB), sentiment amongst builders has increased slightly, to the highest levels since April 2006. The NAHB note that persistently tight mortgage credit conditions, and difficulties in obtaining appraisals continue to drag on builder confidence. The NAHB Housing Market Index only considers single family dwellings, and a reading over 50 would indicate good outlook. The latest NAHB Indexreading is 47 against 48 expected by analysts. Part of the reason for home price increases has been a 17% decline in available inventory in 2012. The Mortgage Bankers Association note that mortgage applications increased 15.2 percent for the week ending 11 January 2013. Refinance activity remains at 82% of total applications. December 2012 existing home sales declined to 4.94 million against 5.10 million expected. Investor activity in housing markets has also been strong, though much tougher to track in available information. In a recent note to investors, Blackstone Group reported that they were spending about $100 million a week on purchasing houses for use as rental properties, largely through foreclosure sales and short sales. Along with Colony Capital LLC and Two Harbors Investment Corporation, Blackstone Group are creating a new asset management investment class, in an area previously dominated by small investors. This is a market that analysts at JPMorgan predict could be worth as much as $1.5 Trillion in the near future. The only point of concern is that these large private equity companies might crowd out more traditional mom and pop investors, or that they may artificially affect price levels of some real estate. The good news in this is that while the housing market is still below historical levels, we have seen continued improvements over the last three years. Housing is no longer a drag on the US economy. Even new housing starts and filings of building permits increased in late 2012. These improvements should allow housing to contribute to GDP growth in the United States in 2013.While US housing markets continue to improve, it now appears that property prices in some parts of China are reaching bubble levels and are now unstable. In China, either housing prices need to adjust and reset drastically, or wages need to increase substantially, though the latter possibility would usher in massive inflation pressures. Demand for housing in China, especially in Beijing, has fuelled investments as China continues on a path of urbanization. Investment in residential property in China now accounts for about 14.4 of overall GDP. This level is above the housing bubble level reached in the United States several years ago. It is not easy to obtain reliable data on Chinese housing markets, though this is one area we will continue to watch this year. Chinese authorities may like the boost to GDP now, though it is highly questionable that this is sustainable for much longer. While not entirely related to this issue, it is notable that the IMF has trimmed global GDP growth projections to just 3.5% in 2013 and 4.1% in 2014, with US growth at 2.0% in 2013. Europe is expected to contract 0.2% in 2013, with several countries expected to be in recession. One of the earliest attempts by the European Central Bank to stimulate and prop up European economies has been Long Term Refinancing Operations (LTRO). Initially these funds were loaned with the expectation of repayment in three years time. Now the first of these LTRO repayments is expected to commence soon. Some LTRO funds were used to purchase Spanish and Italian bonds, so an unwinding of those positions could affect borrowing capability in Spain and Italy. There is a possibility that banks moving to repay LTRO early could affect a sell-off of collateral, or a search for yields in other investments. This will be another of our issues to watch over the next few months, since it may signal a shift in investment strategies, or further deleveraging. The amount of LTRO loans is estimated to be near a Trillion Euros. About 2/3rds of the borrowing was from banks in Spain and Italy (video). The LTRO was successful in allowing for bank funding, and helped avoid a credit crunch. Gradual payback of LTRO will actually be a positive sign for the health of banking in Europe. While banks in Europe may be doing better, demand for automobiles has sunk to a 7 year low point. Some analysts think European auto sales may be near a bottom, and now provide an interesting investment alternative, though indications at the moment suggest a very slow recovery.

G. Moat

Disclosure: I hold positions in Euro futures and some European Sovereign Bonds through the Fisher-Gartman Risk Off ETN (OFF). This article is not a recommendation for investors to either buy, nor to sell, shares in OFF. Investors are advised to perform their own research prior to making investment decisions.