Welcome to the start of a new year. Hopefully all of you had an enjoyable New Years, and are starting off 2013 with a fresh outlook. The same might not be said for politicians in Washington, D.C. who staged a very late night vote to make deals to avoid the Fiscal Cliff. Most stock markets around the globe reacted positively on news that a deal passed the Senate and House of Representatives, though considering the build-up to the vote, the gains in markets appear to be more of a relief rally. The Legislative Branch is empowered to pass spending bills prior to the start of each fiscal year, yet since 1996 it has repeatedly failed to accomplish that task. The previous temporary measures were agreed to in August of 2011, at a time when a failure to negotiate led to sharp market declines. When the first measures passed the Senate early on New Year's Day, the Congressional Budget Office estimated that the deal would add $4 trillion to US debt. The House of Representatives voted on the measures prior to the opening of US stock markets, though the measures that passed should be of continuing concern. President Obama signed the bill into law on 3 January 2013. Of some benefit is extension of Bush era tax cuts, though over the next decade taxes will increase on Americans earning over $400K per year. Capital gains taxes, and taxes on dividends, return to the old rate of 20% instead of the more recent 15%. The deal means taxes increasing for 77% of Americans. What we will need to watch is that previously agreed automatic spending cuts are only extended for two months, which sets the stage for more tough negotiations in March 2013. The deal made on the Fiscal Cliff does nothing to address long term tax reform, nor long term entitlements. Even the IMF suggest that the United States could do more to address long term debt levels. We are likely to see more battles as the debt ceiling approaches, since the US Treasury have indicated that they can only avoid hitting the debt ceiling for about two months. When measured under normal circumstances, the United States already hit the debt ceiling on 31 December 2012. After that the only options beyond defaulting on US Treasuries would be withholding payments to Federal workers, soldiers, or recipients of Social Security. Uncertainty over the outcome held back financial markets in late 2012, so it should not be surprising that we are seeing solid buying volume on stock markets, but this is unlikely to last. On Thursday 3 January 2013 Representative Boehner was reconfirmed as Speaker of the House in a narrow vote, which sets up the next battle over the debt ceiling and further spending cuts.

The latest private sector payrolls report from ADP and Moody's Analytics indicated 215000 jobs were added by private employers, up from 148k in November, and much higher than an expected gain of 133k. There is some criticism of the latest ADP figures that occurs each December, usually blamed upon an accounting quirk, so we might actually see these figures restated next month. The November APD Jobs Report was revised from 118k to 143000. The Department of Labor released unemployment claims data that was estimated due to a lack of information from nine states, including California and Virginia. Initial unemployment claims appear to have increased to 372000 (seasonally adjusted). While I expect some restatement of figures, the trend through 2012 was a slight improvement in employment. Some analysts at Goldman Sachs (GS) and Credit Suisse (CS) are expecting continued employment improvements in early 2013. CME Group project unemployment in the US will decline below 7% by the end of 2013. We can see some of the affects of this trend through increased retail sales. However, the holiday shopping season retails sales indications indicate some retailers doing far better than others. We still do not have figures from retail giants Walmart (WMT) and Best Buy (BBY), though discount stores appear to have seen increased retail sales. The impacts of Hurricane Sandy, headlines about the Fiscal Cliff, and sombre mood following the Connecticut school shooting were thought to have held back holiday spending. Mastercard affiliated research firm SpendingPulse indicated retail sales that they track grew 2% more than in the 2011 holiday shopping season. This holiday shopping season could prove to be the weakest for retailers since 2008.When we consider the long drought conditions across much of the United States in 2012, we expect higher food prices will limit retail sales in early 2013. Guns sales and applications for gun permits increased to historically high levels through 2012. Auto sales slightly increased in December for some domestic auto companies, though not enough to offset large gains through 2012 for Japanese rivals. The biggest gains were posted by Volkswagen Group in 2012 with a 31% increase in sales. Upcoming debt ceiling negotiations may cause some slowing of auto sales in the first quarter of 2013, mostly over uncertainty about the direction of the economy in the United States.

The latest private sector payrolls report from ADP and Moody's Analytics indicated 215000 jobs were added by private employers, up from 148k in November, and much higher than an expected gain of 133k. There is some criticism of the latest ADP figures that occurs each December, usually blamed upon an accounting quirk, so we might actually see these figures restated next month. The November APD Jobs Report was revised from 118k to 143000. The Department of Labor released unemployment claims data that was estimated due to a lack of information from nine states, including California and Virginia. Initial unemployment claims appear to have increased to 372000 (seasonally adjusted). While I expect some restatement of figures, the trend through 2012 was a slight improvement in employment. Some analysts at Goldman Sachs (GS) and Credit Suisse (CS) are expecting continued employment improvements in early 2013. CME Group project unemployment in the US will decline below 7% by the end of 2013. We can see some of the affects of this trend through increased retail sales. However, the holiday shopping season retails sales indications indicate some retailers doing far better than others. We still do not have figures from retail giants Walmart (WMT) and Best Buy (BBY), though discount stores appear to have seen increased retail sales. The impacts of Hurricane Sandy, headlines about the Fiscal Cliff, and sombre mood following the Connecticut school shooting were thought to have held back holiday spending. Mastercard affiliated research firm SpendingPulse indicated retail sales that they track grew 2% more than in the 2011 holiday shopping season. This holiday shopping season could prove to be the weakest for retailers since 2008.When we consider the long drought conditions across much of the United States in 2012, we expect higher food prices will limit retail sales in early 2013. Guns sales and applications for gun permits increased to historically high levels through 2012. Auto sales slightly increased in December for some domestic auto companies, though not enough to offset large gains through 2012 for Japanese rivals. The biggest gains were posted by Volkswagen Group in 2012 with a 31% increase in sales. Upcoming debt ceiling negotiations may cause some slowing of auto sales in the first quarter of 2013, mostly over uncertainty about the direction of the economy in the United States.

Ratings agency S&P commented that they did not feel the Fiscal Cliff deal changed the outlook on the United States for 2013, though they did state that the risk of a recession had been reduced. S&P Ratings project 2013 US GDP growth at 2.2%. Moody's Rating is taking a wait-and-seeapproach to the United States, based upon the expectation of more fiscal negotiations. Moody's has indicated that more actions may be needed to maintain a AAA rating. So far Fitch Ratings have yet to comment about the outlook for the United States, but we have found several other market analysts and gurus weighing in with predictions for 2013 market conditions. Steen Jakobsen, Chief Economist of Saxo Bank, identifies some potentially negative market moving events of which we should be watchful. He points out that the debt burdens and fiscal deficits now in place are the highest since World War II, largely on the back of continual extend-and-pretend policies. He rightly points out that many investors now watch changes in central bank policies and liquidity operations in order to judge market direction. It is like markets are addicted to stimulus, and real levels are unreachable without central bank intervention. In some ways we can expect that the bottom of the markets in 2009 will not be seen again, all due to central bank activity to avoid a repeat of that huge sell-off. If you follow that link from Saxo Bank, there is a PDF with 10 predictions for 2013. Of that list, one of the more interesting items is 30 year US Treasury yields, which Saxo Bank expect to see increase. Currently global bond markets hold three times the invested funds of stock markets, mostly with little to no yield. Despite announcements that the Federal Reserve and the European Central Bank will continue buying sovereign debt to keep interest rates low, there is no guarantee that investors will stick with bonds. Total bond issuance in 2013 is expected to decline in most countries. This may temper demand somewhat, though issuance is expected to increase from the United States, Canada, Russia, India, and China. If we see a correction in bond yields, then it may signal a good time for investors to move some funds back into bonds. Some corporate bonds proved to be better investments in fixed income in 2012 than highly rated sovereign bonds. In a diversified portfolio, it is almost always a good idea to have a portion of investments in fixed income funds. M&G Investments highlights some of the bright spots in fixed income in 2012. While M&G Investments do not expect fixed income markets to perform as well in 2013, they do point out that taking some risk is a necessary part of generating investment gains. Byron Wein of private equity giant Blackstone Partners recently released his ten predictions for 2013. Of note are the S&P falling to near 1300, financial company stocks struggling, further drought impacting food prices, and gold reaching $1900 per ounce on continued Central Bank stimulus and currency debasement.

Ratings agency S&P commented that they did not feel the Fiscal Cliff deal changed the outlook on the United States for 2013, though they did state that the risk of a recession had been reduced. S&P Ratings project 2013 US GDP growth at 2.2%. Moody's Rating is taking a wait-and-seeapproach to the United States, based upon the expectation of more fiscal negotiations. Moody's has indicated that more actions may be needed to maintain a AAA rating. So far Fitch Ratings have yet to comment about the outlook for the United States, but we have found several other market analysts and gurus weighing in with predictions for 2013 market conditions. Steen Jakobsen, Chief Economist of Saxo Bank, identifies some potentially negative market moving events of which we should be watchful. He points out that the debt burdens and fiscal deficits now in place are the highest since World War II, largely on the back of continual extend-and-pretend policies. He rightly points out that many investors now watch changes in central bank policies and liquidity operations in order to judge market direction. It is like markets are addicted to stimulus, and real levels are unreachable without central bank intervention. In some ways we can expect that the bottom of the markets in 2009 will not be seen again, all due to central bank activity to avoid a repeat of that huge sell-off. If you follow that link from Saxo Bank, there is a PDF with 10 predictions for 2013. Of that list, one of the more interesting items is 30 year US Treasury yields, which Saxo Bank expect to see increase. Currently global bond markets hold three times the invested funds of stock markets, mostly with little to no yield. Despite announcements that the Federal Reserve and the European Central Bank will continue buying sovereign debt to keep interest rates low, there is no guarantee that investors will stick with bonds. Total bond issuance in 2013 is expected to decline in most countries. This may temper demand somewhat, though issuance is expected to increase from the United States, Canada, Russia, India, and China. If we see a correction in bond yields, then it may signal a good time for investors to move some funds back into bonds. Some corporate bonds proved to be better investments in fixed income in 2012 than highly rated sovereign bonds. In a diversified portfolio, it is almost always a good idea to have a portion of investments in fixed income funds. M&G Investments highlights some of the bright spots in fixed income in 2012. While M&G Investments do not expect fixed income markets to perform as well in 2013, they do point out that taking some risk is a necessary part of generating investment gains. Byron Wein of private equity giant Blackstone Partners recently released his ten predictions for 2013. Of note are the S&P falling to near 1300, financial company stocks struggling, further drought impacting food prices, and gold reaching $1900 per ounce on continued Central Bank stimulus and currency debasement.

Argus Market Research points out that economies in Europe appear to have stabilized, as purchasing managers indexes showed slight improvements in December 2012. On a global basis, the International Monetary Fund (IMF) is expecting 3.6% growth in 2013, led by China and India. Many countries in Europe are expecting to be in recession throughout 2013. In France, one of the largest economies in Europe, the number of unemployed reached 3.132 million people, the highest level since 1998. Tough austerity measures are also beginning to have a negative real affect in Portugal, who are now asking the IMF and European Union to give some form of relief on continued demands. Investors may want to watch European markets, and shares of European companies with listings in the United States, to see if some buying opportunities appear. It is important to keep in mind that while Europe may be at a bottom, there is a long way to go until meaningful economic recovery and growth return. Despite the high growth rate projections for China, Argus Research point out that South Africa still has a higher GDP per capita and Brazil is even higher in GDP per capita. Investors may find several opportunities in companies headquartered in South Africa and Brazil, though the political climate aspect of risk is different than that found with US and European companies. South America may prove to be a good investment choice in 2013, as indicated by the recent upgrade by S&P Ratings for Chile from AA- to AA+. We can also expect to read more about problems in Greece, as highlighted in a report released on Christmas Eve. The report highlights the difficulties of Greece in collecting an estimated €53 billion (Euros) of outstanding taxes. In that report, the European Union and the IMF suggest that only about 20% of that amount might be collectable, and that Greece needs more people to investigate the largest debtors in Greece. We might reasonably expect more write-downs of Greek debt, new bailouts, or further missed targets in 2013. Despite numerous predictions of a Euro collapse, or an exit of Greece from the Eurozone (called a Grexit), 2012 proved that Europe can bounce back, though the road to full economic recovery will be slow. However, problems do remain to be solved in Greece, perhaps best highlighted by the discovery that the former Prime Minister Papaconstantinou was directly connected to four names removed from a list of possible tax evaders provided by the IMF to the Greek Minister of Justice. Given the revelations of corruption in Greece, it should not be too surprising that someone in the Greek government altered the IMF list (also called the Lagarde List) to remove names of politicians and their family members who have large Swiss bank accounts outside of Greece.

Overseas investments always present different risks, as highlighted by an unusual incident in China where Citic Trust Company delayed an interest payment to investors due to one of it's debtors missing a major payment. Researchers at the Federal Reserve note that the rebound in China's economy is uneven, and that demand for loans in China have decreased, which puts into question the IMF's projection of 8% growth in 2013. Also of note in that report, due out in full this month, is that inventories of raw materials have risen to very high levels. We may see a sharp decline in commodity prices in early 2013, considering that China is a very large purchaser of raw materials from around the world. Official Chinese government figures on the state of their economy are always open to scepticism, though global bank HSBC have a fairly reliable research team looking into the Chinese economy. The December HSBC survey of purchasing managers index, in China, indicates an improvement in economic conditions, with a 51.5 PMI reading being the highest since early 2011. There is a great set of data available at this link for the latest HSBC figures on China's economy, and it is notable that growth has stagnated for most of 2012. It remains to be seen if new leadership in China can usher in a new era of renewed growth. Global mining giants BHP Billiton (BHP), Rio Tinto (RIO) and Vale (VALE) may experience reduced revenues due to price declines on iron ore and other raw materials due to slowing demand. Investment bank Barclays Capital encourage buying gold on dipsthroughout 2013, and they project a decline in the Japanese Yen (JPY). Upcoming Basel III bank regulations, with 2013 target capital ratios ahead of 2018 compliance, may affect gold markets through the year. The Japanese Yen has been falling against the Dollar (USD) and Euro (EUR) recently, partially on the promise by newly elected Prime Minister Shinzo Abe to push the Bank of Japan to directly purchase Japanese government bonds in order to stimulate the economy. Such a policy shift is active currency devaluation. When combined with gains in the Euro and an improved US economy, it is not surprising to see the recent moves in the Yen.

Argus Market Research points out that economies in Europe appear to have stabilized, as purchasing managers indexes showed slight improvements in December 2012. On a global basis, the International Monetary Fund (IMF) is expecting 3.6% growth in 2013, led by China and India. Many countries in Europe are expecting to be in recession throughout 2013. In France, one of the largest economies in Europe, the number of unemployed reached 3.132 million people, the highest level since 1998. Tough austerity measures are also beginning to have a negative real affect in Portugal, who are now asking the IMF and European Union to give some form of relief on continued demands. Investors may want to watch European markets, and shares of European companies with listings in the United States, to see if some buying opportunities appear. It is important to keep in mind that while Europe may be at a bottom, there is a long way to go until meaningful economic recovery and growth return. Despite the high growth rate projections for China, Argus Research point out that South Africa still has a higher GDP per capita and Brazil is even higher in GDP per capita. Investors may find several opportunities in companies headquartered in South Africa and Brazil, though the political climate aspect of risk is different than that found with US and European companies. South America may prove to be a good investment choice in 2013, as indicated by the recent upgrade by S&P Ratings for Chile from AA- to AA+. We can also expect to read more about problems in Greece, as highlighted in a report released on Christmas Eve. The report highlights the difficulties of Greece in collecting an estimated €53 billion (Euros) of outstanding taxes. In that report, the European Union and the IMF suggest that only about 20% of that amount might be collectable, and that Greece needs more people to investigate the largest debtors in Greece. We might reasonably expect more write-downs of Greek debt, new bailouts, or further missed targets in 2013. Despite numerous predictions of a Euro collapse, or an exit of Greece from the Eurozone (called a Grexit), 2012 proved that Europe can bounce back, though the road to full economic recovery will be slow. However, problems do remain to be solved in Greece, perhaps best highlighted by the discovery that the former Prime Minister Papaconstantinou was directly connected to four names removed from a list of possible tax evaders provided by the IMF to the Greek Minister of Justice. Given the revelations of corruption in Greece, it should not be too surprising that someone in the Greek government altered the IMF list (also called the Lagarde List) to remove names of politicians and their family members who have large Swiss bank accounts outside of Greece.

Overseas investments always present different risks, as highlighted by an unusual incident in China where Citic Trust Company delayed an interest payment to investors due to one of it's debtors missing a major payment. Researchers at the Federal Reserve note that the rebound in China's economy is uneven, and that demand for loans in China have decreased, which puts into question the IMF's projection of 8% growth in 2013. Also of note in that report, due out in full this month, is that inventories of raw materials have risen to very high levels. We may see a sharp decline in commodity prices in early 2013, considering that China is a very large purchaser of raw materials from around the world. Official Chinese government figures on the state of their economy are always open to scepticism, though global bank HSBC have a fairly reliable research team looking into the Chinese economy. The December HSBC survey of purchasing managers index, in China, indicates an improvement in economic conditions, with a 51.5 PMI reading being the highest since early 2011. There is a great set of data available at this link for the latest HSBC figures on China's economy, and it is notable that growth has stagnated for most of 2012. It remains to be seen if new leadership in China can usher in a new era of renewed growth. Global mining giants BHP Billiton (BHP), Rio Tinto (RIO) and Vale (VALE) may experience reduced revenues due to price declines on iron ore and other raw materials due to slowing demand. Investment bank Barclays Capital encourage buying gold on dipsthroughout 2013, and they project a decline in the Japanese Yen (JPY). Upcoming Basel III bank regulations, with 2013 target capital ratios ahead of 2018 compliance, may affect gold markets through the year. The Japanese Yen has been falling against the Dollar (USD) and Euro (EUR) recently, partially on the promise by newly elected Prime Minister Shinzo Abe to push the Bank of Japan to directly purchase Japanese government bonds in order to stimulate the economy. Such a policy shift is active currency devaluation. When combined with gains in the Euro and an improved US economy, it is not surprising to see the recent moves in the Yen.

In our watch of global macro events that could affect economic conditions, our first surprise of 2013 comes from a rare speech by North Korean leader Kim Jong-un. In that speech he called for an end to the conflict with South Korea, possibly in an appeal for further aid and assistance. It's too early to tell how genuine the intentions were in that speech, though obviously an end to conflict with North Korea could boost economies in northeast Asia, especially the economy of South Korea. The other possible reason behind the move by North Korea may be the success of continued tough economic sanctions against Iran. As Europe and the United States moved to isolate Iran economically, Iran damaged their internal affairs by attempting to enact currency control and a new currency exchange. Some analysts feel it is only a matter of time for Iran's nuclear ambitions to be successful, but it is not clear that the people of Iran will continue supporting the current ruling group. The continued decline of Syria, and changes in North Africa due to Arab Spring events, may prompt more changes in the Middle East and Near East. During research and compilation of this article, some news is arriving that Venezuelan President Hugo Chavez may be in his last days, or perhaps is already dead. If Chavez fails to appear for 10 January 2013 inauguration, Venezuela would stage another round of new elections. Hugo Chavez has been fighting an unspecified form of cancer, and has been seeking treatment in Cuba throughout much of the last year. Venezuela is one of the largest oil producing countries in the world, though production has declined as Chavez moved to nationalize much of the oil industry, ceasing assets from private companies. Obviously expanded conflict zones or collapses of ruling parties could affect the price of oil, international shipping, or increase military expenses in Western nations going through economic recovery. Hopefully the current conflicts find some resolution this year, and we see a decline in conflicts, rather than an escalation. Most of these would be potential Black Swan events, and they would rarely create a lasting negative economic impact.

In our watch of global macro events that could affect economic conditions, our first surprise of 2013 comes from a rare speech by North Korean leader Kim Jong-un. In that speech he called for an end to the conflict with South Korea, possibly in an appeal for further aid and assistance. It's too early to tell how genuine the intentions were in that speech, though obviously an end to conflict with North Korea could boost economies in northeast Asia, especially the economy of South Korea. The other possible reason behind the move by North Korea may be the success of continued tough economic sanctions against Iran. As Europe and the United States moved to isolate Iran economically, Iran damaged their internal affairs by attempting to enact currency control and a new currency exchange. Some analysts feel it is only a matter of time for Iran's nuclear ambitions to be successful, but it is not clear that the people of Iran will continue supporting the current ruling group. The continued decline of Syria, and changes in North Africa due to Arab Spring events, may prompt more changes in the Middle East and Near East. During research and compilation of this article, some news is arriving that Venezuelan President Hugo Chavez may be in his last days, or perhaps is already dead. If Chavez fails to appear for 10 January 2013 inauguration, Venezuela would stage another round of new elections. Hugo Chavez has been fighting an unspecified form of cancer, and has been seeking treatment in Cuba throughout much of the last year. Venezuela is one of the largest oil producing countries in the world, though production has declined as Chavez moved to nationalize much of the oil industry, ceasing assets from private companies. Obviously expanded conflict zones or collapses of ruling parties could affect the price of oil, international shipping, or increase military expenses in Western nations going through economic recovery. Hopefully the current conflicts find some resolution this year, and we see a decline in conflicts, rather than an escalation. Most of these would be potential Black Swan events, and they would rarely create a lasting negative economic impact.

This is a slow time of year for housing news, though the New York Times reports that a possible settlement may be near between 14 large banks and the government over housing loan abuses. The amount suggested is near $10 billion, with about $3.75 billion going to compensate people who have already lost their homes, and an additional $1.5 billion in unspecified relief. Negotiations continue through the Office of the Comptroller of the Currency and the 14 banks, though a settlement would relieve banks of the task of reviewing many loans already at some phase of the foreclosure process. Housing has been one of the few bright spots in the US economy in 2012, so this would help continue that progress. Housing research firm CoreLogic released the latest figures on the Shadow Inventory of properties as of October 2012. In that report, CoreLogic notes Shadow Inventory declined by 12% to an estimated 2.3 million units, or about seven months of supply. The Federal Reserve will be continuing the program to purchase Mortgage Backed Securities (MBS) on the open market, though it appears they are somewhat frustrated with mortgage rates that remain higher than they expected. The Federal Reserve challenges the notion of increased costs, and suggest that a 2.6% thirty year fixed mortgage should be possible under current market conditions. While the Federal Reserve do not expect mortgage rates to drop under 3%, they do think mortgage rates could fall a bit further this year. The Dallas Federal Reserve released new studies on Service Sector Activity in Texas, indicating longer working week and stronger labor demand growth. That Dallas Fed note some optimism amongst businesses in Texas, which bodes well for the region in early 2013. In a strange twist on the ongoing economic crisis we have faced since 2008, bailed out insurance company AIG (AIG) is rolling out a two week long ad campaign basically thanking the government for saving the company. AIG received about $182 billion in bailout funding as the government took over the failed insurer, though the US Treasury managed to sell all holdings in AIG with a profit of $22.7 billion in 2012. The Federal Open Markets Committee (FOMC) released mid December 2012meeting minutes, indicating a desire to discontinue some stimulus measures by the end of 2013. So with some positive developments, and our overview of events to watch for in 2013, we wish you a prosperous year of investing.

G. Moat

Dislosure: I hold a long positions in Credit Suisse (CS) and Vale (VALE). This article is not a recommendation for investors to either buy, nor to sell, shares in Credit Suisse nor Vale. Investors are advised to perform their own research prior to making investment decisions.

This is a slow time of year for housing news, though the New York Times reports that a possible settlement may be near between 14 large banks and the government over housing loan abuses. The amount suggested is near $10 billion, with about $3.75 billion going to compensate people who have already lost their homes, and an additional $1.5 billion in unspecified relief. Negotiations continue through the Office of the Comptroller of the Currency and the 14 banks, though a settlement would relieve banks of the task of reviewing many loans already at some phase of the foreclosure process. Housing has been one of the few bright spots in the US economy in 2012, so this would help continue that progress. Housing research firm CoreLogic released the latest figures on the Shadow Inventory of properties as of October 2012. In that report, CoreLogic notes Shadow Inventory declined by 12% to an estimated 2.3 million units, or about seven months of supply. The Federal Reserve will be continuing the program to purchase Mortgage Backed Securities (MBS) on the open market, though it appears they are somewhat frustrated with mortgage rates that remain higher than they expected. The Federal Reserve challenges the notion of increased costs, and suggest that a 2.6% thirty year fixed mortgage should be possible under current market conditions. While the Federal Reserve do not expect mortgage rates to drop under 3%, they do think mortgage rates could fall a bit further this year. The Dallas Federal Reserve released new studies on Service Sector Activity in Texas, indicating longer working week and stronger labor demand growth. That Dallas Fed note some optimism amongst businesses in Texas, which bodes well for the region in early 2013. In a strange twist on the ongoing economic crisis we have faced since 2008, bailed out insurance company AIG (AIG) is rolling out a two week long ad campaign basically thanking the government for saving the company. AIG received about $182 billion in bailout funding as the government took over the failed insurer, though the US Treasury managed to sell all holdings in AIG with a profit of $22.7 billion in 2012. The Federal Open Markets Committee (FOMC) released mid December 2012meeting minutes, indicating a desire to discontinue some stimulus measures by the end of 2013. So with some positive developments, and our overview of events to watch for in 2013, we wish you a prosperous year of investing.

G. Moat

Dislosure: I hold a long positions in Credit Suisse (CS) and Vale (VALE). This article is not a recommendation for investors to either buy, nor to sell, shares in Credit Suisse nor Vale. Investors are advised to perform their own research prior to making investment decisions.

Whether you followed Mayan calendars, Hopi legends, Chinese ancient texts, the mysterious Planet X, or simply wondered about interesting number combinations on the calendar, the fact that you are reading this indicates that you have made it past most popular myths about the end of the world. I wish we could state the same for the Fiscal Cliff negotiations, though the US Government appear to be following the Greek calendar (modern, not ancient). The main battle areas have been taxes and entitlements, with some unusual proposals thrown into the mix. One of the those is an idea called Chained CPI (Consumer Price Index), which attempts to find an inflation rate that could account for changes in spending habits, rather than the currently used fixed basket of goods method of calculating CPI. The original deadline for Fiscal Cliff negotiations was 21 December 2012, based upon a planned recess of Congress until early January. Some form of a compromise was expected by that time, though Speaker of the House John Boehner choose to put forward a "Plan B" limiting tax increases to those with incomes over $400k annually. After an all-too-common procedural vote, Plan B was brought to the floor of the House of Representatives for discussion, despite that it was unlikely to pass a vote in the Senate. The measure failed to go forward to a vote, as Representative Boehner realized that a large group of Republican House members opposed any tax increases. In the absence of some form of compromise, provisions already in place from late 2011 will allow taxes to increase for everyone. The fall-out of this failure may cause a change in leadership in the House of Representatives, with Representative Eric Cantor a likely successor. There remains a slight possibility some form of compromise, and a quick vote, will happen prior to the end of 2012, though with a comprehensive deal unlikely, we may see a bit more can kicking with temporary measures passing to force negotiations into the middle of 2013. There are two major problems with pushing negotiations further into 2013. The first issue is that immediate spending cuts may cause a decline in funding that negates the slight recent improvement in the US economy, possibly tipping the country into another recession. The second risk is that Moody's and Fitch Ratings may downgrade the credit worthiness of the United States by the end of 2013, followed by ratings decreases of major corporations, which would increase borrowing costs across the United States.

There is a much bigger issue in Fiscal Cliff negotiations, and economist Michael Feroli of JPMorgan points out that whether short term measures, or ten year planning, current efforts do almost nothing to address the longer term debt trajectory of the United States. Fixation on a ten (10) year budget misses the chance to create lasting improvements in national debt under a 20 or 30 year time period. Perhaps a little controversial, though the implication is that politicians are attempting more to boost their reputations amongst the electorate, rather than creating lasting solutions. In mid December it appeared that Fiscal Cliff negotiations were much closer in concept and proposals than politicians led the public to believe, so the idea that discussions become more politicized is not too far off the mark. Since the United States is still the world's largest economy, failure to resolve differences could lead to a 0.5% contraction in the US economy, and impact many countries in Europe already in recession. The automatic spending cuts will affect the majority of small businesses and most individual tax payers, though larger corporations are unlikely to increase capital expenditures until a clear direction is decided amongst politicians. The late night failure of Plan B led to a steep sell-off in stock markets, though the S&P 500 did end up 1.17% on the week. The last trading week of December is likely to see much shorter volumes due to Christmas holiday, so greater intra-day volatility is likely, though any further sell-off may not happen until early January 2013, if at all. Oddly enough, a Reuters poll of market analysts found that most expected global stock markets to gain towards the end of 2013, even if a European recession and Fiscal Cliff impasse rattle markets early in 2013.

There is a much bigger issue in Fiscal Cliff negotiations, and economist Michael Feroli of JPMorgan points out that whether short term measures, or ten year planning, current efforts do almost nothing to address the longer term debt trajectory of the United States. Fixation on a ten (10) year budget misses the chance to create lasting improvements in national debt under a 20 or 30 year time period. Perhaps a little controversial, though the implication is that politicians are attempting more to boost their reputations amongst the electorate, rather than creating lasting solutions. In mid December it appeared that Fiscal Cliff negotiations were much closer in concept and proposals than politicians led the public to believe, so the idea that discussions become more politicized is not too far off the mark. Since the United States is still the world's largest economy, failure to resolve differences could lead to a 0.5% contraction in the US economy, and impact many countries in Europe already in recession. The automatic spending cuts will affect the majority of small businesses and most individual tax payers, though larger corporations are unlikely to increase capital expenditures until a clear direction is decided amongst politicians. The late night failure of Plan B led to a steep sell-off in stock markets, though the S&P 500 did end up 1.17% on the week. The last trading week of December is likely to see much shorter volumes due to Christmas holiday, so greater intra-day volatility is likely, though any further sell-off may not happen until early January 2013, if at all. Oddly enough, a Reuters poll of market analysts found that most expected global stock markets to gain towards the end of 2013, even if a European recession and Fiscal Cliff impasse rattle markets early in 2013.

There is some room for optimism, with China moving to alter the exchange rate of the Yuan to allow for more flexibility. This is a necessary move to enable the Yuan to be used more often in global trade, since currency pegand trading restrictions create an artificial value to China's currency. There have been numerous news articles about unusual transaction and collateral moves in China, such as hording raw materials, so the Chinese government may be reaching a point where looser exchange policies are inevitable. Combined with potentially lower US Dollar (USD), Japanese Yen (JPY), and Euro (EUR) values in 2013 due to additional stimulus measures, the timing Yuan (CNY) flexibility may result in very little volatility. Russell Emerging Markets Funds estimatesChinese corporate earnings may increase at least 10% in 2013. Goldman Sachs also projected increased economic growth through 2013 in China. After recent elections in Japan brought Prime Minister Shinzo Abe back to power in a landslide victory, there was little surprise that the Bank of Japan increased their inflation target for 2013, on the back of further asset purchases and stimulus measures. We may see some pressure on the currently high JPY valuation, which could bolster the export market for Japan, though it has been decades since the Japanese economy influenced world markets in a major way. Targeting higher inflation will push Japanese consumers to spend more sooner, in anticipation of higher future prices of goods and services, though this will create demand upon the Bank of Japan to increase the amount of currency in circulation. While this money printing serves to devalue the Yen in the near term, potentially helping exports, few investors are willing to bet against Japan, especially with European economies still showing little sign of improvement. The more immediate worry of Shinzo Abe returning to power in Japan is that he may push the government to take a more hard-line stance against a Chinese territorial claim over disputed islands. The main issue is not the uninhabited islands, but instead the right to pursue offshore drilling for oil and natural gas. In the latest move in this dispute, China attempted to use geological characteristics of the continental shelf to bolster their claim to these disputed islands. So far the dispute has been peaceful, though Chinese consumers have greatly curtailed spending on Japanese branded products, and there have been some protests near Japanese owned factories in China. There are some economic incentives for Japan and China to work together to solve this dispute, though a break-down in discussions could impact markets in 2013.

There is some room for optimism, with China moving to alter the exchange rate of the Yuan to allow for more flexibility. This is a necessary move to enable the Yuan to be used more often in global trade, since currency pegand trading restrictions create an artificial value to China's currency. There have been numerous news articles about unusual transaction and collateral moves in China, such as hording raw materials, so the Chinese government may be reaching a point where looser exchange policies are inevitable. Combined with potentially lower US Dollar (USD), Japanese Yen (JPY), and Euro (EUR) values in 2013 due to additional stimulus measures, the timing Yuan (CNY) flexibility may result in very little volatility. Russell Emerging Markets Funds estimatesChinese corporate earnings may increase at least 10% in 2013. Goldman Sachs also projected increased economic growth through 2013 in China. After recent elections in Japan brought Prime Minister Shinzo Abe back to power in a landslide victory, there was little surprise that the Bank of Japan increased their inflation target for 2013, on the back of further asset purchases and stimulus measures. We may see some pressure on the currently high JPY valuation, which could bolster the export market for Japan, though it has been decades since the Japanese economy influenced world markets in a major way. Targeting higher inflation will push Japanese consumers to spend more sooner, in anticipation of higher future prices of goods and services, though this will create demand upon the Bank of Japan to increase the amount of currency in circulation. While this money printing serves to devalue the Yen in the near term, potentially helping exports, few investors are willing to bet against Japan, especially with European economies still showing little sign of improvement. The more immediate worry of Shinzo Abe returning to power in Japan is that he may push the government to take a more hard-line stance against a Chinese territorial claim over disputed islands. The main issue is not the uninhabited islands, but instead the right to pursue offshore drilling for oil and natural gas. In the latest move in this dispute, China attempted to use geological characteristics of the continental shelf to bolster their claim to these disputed islands. So far the dispute has been peaceful, though Chinese consumers have greatly curtailed spending on Japanese branded products, and there have been some protests near Japanese owned factories in China. There are some economic incentives for Japan and China to work together to solve this dispute, though a break-down in discussions could impact markets in 2013.

Fitch Ratings has warned that a failure to resolve Fiscal Cliff differences could derail the recovery in US housing markets. While the Fiscal Cliff is discouraging investment, corporate spending, and hiring, in the near term the impact is more psychological than damaging. As we saw with the JPMorgan analysis above, real improvements in the US economy are being overlooked as the news focuses on Fiscal Cliff discussions. When we compare unsold housing inventory to GDP growth, we find some correlation in the downturn to the US economy with a growth in unsold housing inventories beyond one year. While much of the current economic crisis has been driven by banking sector troubles, the growth of unemployment has been fuelled by a decline in construction workers. This is a slightly loose correlation, though house building and increased demand for properties can drive the economy upwards in 2013. Housing has been the bright spot in the economy this year, so this idea is one theme investors may want to exploit further into 2013.

It would be tough to write an article without mentioning Greece, which has been the country to follow this year for potential negative market impact. Greece is finally moving to tackle tax evasion, possibly due to a great shortfall in expected tax revenues. There remains a need for Greek leadersto draw a plan to move Greece forward, though A move by the European Central Bank (ECB) to once again allow Greek bonds to be used as collateral will stabilize the credit sector in Greece. One final hurdle that Greece overcame was a court challenge in Germany over the legality of Greek bond purchases by the ECB and usage of Greek bonds as collateral. A lower European Court threw out the case as manifestly inadmissible, clearing the way for the action by the ECB; this case also affects ECB purchases of Portuguese, Spanish, and Italian bonds. Greece still has a long way to any real recovery, and the economies of Spain and Portugal are still lagging behind. Progress is definitely being made in Europe, even if it is slow and there remain hurdles ahead. As independent investors we should be careful to watch for speculative moves in stock markets, and instead focus on areas where markets have improved. Negative events in 2012 are now behind us, and even those Argentine sailors stalled in Ghana (on moves by a hedge fund to collect on unpaid Argentine bonds) are once again sailing across the Atlantic Ocean. So with some positive prospects for 2013 ahead of us, we'll be seeing again in 2013 in our next article. We wish you all a Merry Christmas and a Happy New Year.

G. Moat

Fitch Ratings has warned that a failure to resolve Fiscal Cliff differences could derail the recovery in US housing markets. While the Fiscal Cliff is discouraging investment, corporate spending, and hiring, in the near term the impact is more psychological than damaging. As we saw with the JPMorgan analysis above, real improvements in the US economy are being overlooked as the news focuses on Fiscal Cliff discussions. When we compare unsold housing inventory to GDP growth, we find some correlation in the downturn to the US economy with a growth in unsold housing inventories beyond one year. While much of the current economic crisis has been driven by banking sector troubles, the growth of unemployment has been fuelled by a decline in construction workers. This is a slightly loose correlation, though house building and increased demand for properties can drive the economy upwards in 2013. Housing has been the bright spot in the economy this year, so this idea is one theme investors may want to exploit further into 2013.

It would be tough to write an article without mentioning Greece, which has been the country to follow this year for potential negative market impact. Greece is finally moving to tackle tax evasion, possibly due to a great shortfall in expected tax revenues. There remains a need for Greek leadersto draw a plan to move Greece forward, though A move by the European Central Bank (ECB) to once again allow Greek bonds to be used as collateral will stabilize the credit sector in Greece. One final hurdle that Greece overcame was a court challenge in Germany over the legality of Greek bond purchases by the ECB and usage of Greek bonds as collateral. A lower European Court threw out the case as manifestly inadmissible, clearing the way for the action by the ECB; this case also affects ECB purchases of Portuguese, Spanish, and Italian bonds. Greece still has a long way to any real recovery, and the economies of Spain and Portugal are still lagging behind. Progress is definitely being made in Europe, even if it is slow and there remain hurdles ahead. As independent investors we should be careful to watch for speculative moves in stock markets, and instead focus on areas where markets have improved. Negative events in 2012 are now behind us, and even those Argentine sailors stalled in Ghana (on moves by a hedge fund to collect on unpaid Argentine bonds) are once again sailing across the Atlantic Ocean. So with some positive prospects for 2013 ahead of us, we'll be seeing again in 2013 in our next article. We wish you all a Merry Christmas and a Happy New Year.

G. Moat

All eyes were on the Greek Bond Buy-back recently to see if this important step in the Greek saga could be completed. The first barrier was the four largest Greek banks agreeing to participate in the debt buy-back. This was important since Greek banks will be receiving most of the next aid tranche in order to recapitalize. Greek banks are some of the largest holders of Greek debt, due to rules put in place by the Greek Central Bank biasing holdings of Greek bonds. The buy-back would allow a revaluation of assets, in order to boost Tier 1 capital ratios. Unfortunately most trading borses (stock or commodity exchanges) already place holdings in Greek debt at a zero rating (effectively worthless) for purposes of collateral, which limits the ability of Greek banks to trade outside the borders of Greece. More importantly it seems that the worry of a bank run, or a return to large withdrawals from Greek banks, is the primary concern of this move. Initial offerings from private Greek bond holders topped €30 billion(Euros), roughly equal to the holdings of participating Greek banks. The bidding ranged from €0.302 minimum to €0.401 maximum per Euro of face value, depending upon maturity dates. Since this is a voluntary buy-back, participating investors would be writing down their holdings in Greek debt, in the hopes of some future pay-back on the swapped Greek bonds. Compared to earlier in 2012, when Greece forced losses with the use of Collective Action Clauses (CACs), this buy-back was more orderly, and is unlikely to trigger pay-outs on Credit Default Swaps (CDS) against Greek sovereign default. The benefit to Greece would be a reduction in debt near €20 billion (Euros). The early 2012 application of CACs caused a 75% devaluation of Greek bond holdings, so further devaluation in the form of a buy-back was expected to face some opposition. Given that some hold-outs (namely hedge funds) may choose to not participate in the hopes of some full payment many years from now, Greece is beginning to look like Argentina. Perhaps it was not too surprising that initial participation in the debt buy-back was dismal enough to prompt an extension of the deadline. In doing so, Greece may hope to reduce their overall long term debt more than €20 billion (Euros). As mentioned in a previous article, Greece needs about €10 billion (Euros) additional funds to complete the debt buy-back, though it was not clear from where those funds would come. In a report in Ekathimerini, it appears that the Eurogroup will provide that funding, if buy-back participation is high enough. That amount was never mentioned in the original aid tranche and agreement reported earlier. At 12:00 GMT 11 December 2012, we heard that the debt buy-back fell short of the target amount by about €450 million (Euros). Greek debt-to-GDP is expected to fall to 126.6% by 2020 instead of a target 124%. Total bids and offers where €31.8 billion (Euros) with an average offer of €0.335, or about a 66.5% devaluation. In the early 2012 application of CACs on private debt holders, the forced devaluation was about 75%. This sets a bad precedent for valuation of sovereign debt holdings, at least for any countries without an A or higher credit rating. Early on 13 December, the European Union approved the latest disbursement of Greek aid. It would not surprise me to see this action play out again prior to 2020 for Greece, especially with 24.8% unemployment. At any rate, we can put the Greek issue behind us for at least another year, or until the next round of Greek elections.

All eyes were on the Greek Bond Buy-back recently to see if this important step in the Greek saga could be completed. The first barrier was the four largest Greek banks agreeing to participate in the debt buy-back. This was important since Greek banks will be receiving most of the next aid tranche in order to recapitalize. Greek banks are some of the largest holders of Greek debt, due to rules put in place by the Greek Central Bank biasing holdings of Greek bonds. The buy-back would allow a revaluation of assets, in order to boost Tier 1 capital ratios. Unfortunately most trading borses (stock or commodity exchanges) already place holdings in Greek debt at a zero rating (effectively worthless) for purposes of collateral, which limits the ability of Greek banks to trade outside the borders of Greece. More importantly it seems that the worry of a bank run, or a return to large withdrawals from Greek banks, is the primary concern of this move. Initial offerings from private Greek bond holders topped €30 billion(Euros), roughly equal to the holdings of participating Greek banks. The bidding ranged from €0.302 minimum to €0.401 maximum per Euro of face value, depending upon maturity dates. Since this is a voluntary buy-back, participating investors would be writing down their holdings in Greek debt, in the hopes of some future pay-back on the swapped Greek bonds. Compared to earlier in 2012, when Greece forced losses with the use of Collective Action Clauses (CACs), this buy-back was more orderly, and is unlikely to trigger pay-outs on Credit Default Swaps (CDS) against Greek sovereign default. The benefit to Greece would be a reduction in debt near €20 billion (Euros). The early 2012 application of CACs caused a 75% devaluation of Greek bond holdings, so further devaluation in the form of a buy-back was expected to face some opposition. Given that some hold-outs (namely hedge funds) may choose to not participate in the hopes of some full payment many years from now, Greece is beginning to look like Argentina. Perhaps it was not too surprising that initial participation in the debt buy-back was dismal enough to prompt an extension of the deadline. In doing so, Greece may hope to reduce their overall long term debt more than €20 billion (Euros). As mentioned in a previous article, Greece needs about €10 billion (Euros) additional funds to complete the debt buy-back, though it was not clear from where those funds would come. In a report in Ekathimerini, it appears that the Eurogroup will provide that funding, if buy-back participation is high enough. That amount was never mentioned in the original aid tranche and agreement reported earlier. At 12:00 GMT 11 December 2012, we heard that the debt buy-back fell short of the target amount by about €450 million (Euros). Greek debt-to-GDP is expected to fall to 126.6% by 2020 instead of a target 124%. Total bids and offers where €31.8 billion (Euros) with an average offer of €0.335, or about a 66.5% devaluation. In the early 2012 application of CACs on private debt holders, the forced devaluation was about 75%. This sets a bad precedent for valuation of sovereign debt holdings, at least for any countries without an A or higher credit rating. Early on 13 December, the European Union approved the latest disbursement of Greek aid. It would not surprise me to see this action play out again prior to 2020 for Greece, especially with 24.8% unemployment. At any rate, we can put the Greek issue behind us for at least another year, or until the next round of Greek elections.

Greece is certainly not investment grade with a credit rating of CCC, one level above official default, though there remain some solid bond choices in other countries. Sovereign credit ratings will also affect the ratings of corporations in those countries, which impacts the pricing of corporate bonds. The announcement that Mario Monti is resigning as Prime Minister of Italy send secondary market Italian bond prices soaring. The announcement appears to have been prompted by a failure of support from the People of Liberty party, of former Prime Minister Silvio Berlusconi. Just to add some possible turmoil to the direction of the Italian economy, there is now a rumour that Berlusconi will once again run for Prime Minister. Spain has a BBB rating, while Portugal is one step lower at BB. While two Spanish headquarterd banks have managed to maintain a higher credit rating than Spain, that situation is reversed in Portugal, with major Portuguese banks credit ratings under the level of the sovereign rating. Portugal remains in recession despite €78 billion (Euros) in aid from the Eurozone and International Monetary Fund (IMF). Despite the recession in Portugal, and ongoing concern over debt levels in Spain, European markets rallied to new 2012 highs following the Greek debt buy-back. Investors seemingly ignored comments from the German Economic Minister that weak industrial output will slow the German economy through this winter. It is difficult to see what could drive equities markets in Europe higher, though with many companies share prices still under late 2010 or early 2011 levels, some investors may find holding into late 2013 or longer could be more profitable. The downgrade of France under AAA makes it difficult to find better safe haven bond investments. In the European Union, Germany, Austria, Denmark, Finland, Luxembourg, the Netherlands, Sweden, and the United Kingdom maintain a AAA through Fitch Ratings. Outside the European Union, Canada, Australia, Singapore, Switzerland, Norway, and the United States still enjoy AAA, though there have been some downgrades from Moody's and S&P Ratings recently. In early 2009 my feeling was that Swiss and Norwegian companies would fair better than other companies, and that formed the basis of my investment research at that time. Looking forward many more years, I feel we may see more economic improvement in Asia, though not through A+ rated China. Even with Australia still a good investment direction, the economy is very much tied to infrastructure spending in China, and the continued exports of raw materials to China. We now see some slowing in business activity in Australia, which may indicate some slowing in the near term. Many individual southeast Asia countries should be viewed as frontier economies, though we may soon see a few emerging market investment opportunities there. One country that is poised at the hub of trade in southeast Asia is Singapore, the location of one of the largest shipping ports in the world. Singapore operate a sovereign wealth fund and a stringent monetary authority. Despite that Singapore does not need to issue bonds, doing so helps the credit ratings of companies in Singapore. M&G investments has a great report and video on Singapore. We will be researching southeast Asian investment opportunities, and some west African frontier investment opportunities through early 2013. My feeling is that these frontier economies, with large mobile workforces, largely untapped natural resources, and open trade routes, may become the next long term investment opportunity.

Greece is certainly not investment grade with a credit rating of CCC, one level above official default, though there remain some solid bond choices in other countries. Sovereign credit ratings will also affect the ratings of corporations in those countries, which impacts the pricing of corporate bonds. The announcement that Mario Monti is resigning as Prime Minister of Italy send secondary market Italian bond prices soaring. The announcement appears to have been prompted by a failure of support from the People of Liberty party, of former Prime Minister Silvio Berlusconi. Just to add some possible turmoil to the direction of the Italian economy, there is now a rumour that Berlusconi will once again run for Prime Minister. Spain has a BBB rating, while Portugal is one step lower at BB. While two Spanish headquarterd banks have managed to maintain a higher credit rating than Spain, that situation is reversed in Portugal, with major Portuguese banks credit ratings under the level of the sovereign rating. Portugal remains in recession despite €78 billion (Euros) in aid from the Eurozone and International Monetary Fund (IMF). Despite the recession in Portugal, and ongoing concern over debt levels in Spain, European markets rallied to new 2012 highs following the Greek debt buy-back. Investors seemingly ignored comments from the German Economic Minister that weak industrial output will slow the German economy through this winter. It is difficult to see what could drive equities markets in Europe higher, though with many companies share prices still under late 2010 or early 2011 levels, some investors may find holding into late 2013 or longer could be more profitable. The downgrade of France under AAA makes it difficult to find better safe haven bond investments. In the European Union, Germany, Austria, Denmark, Finland, Luxembourg, the Netherlands, Sweden, and the United Kingdom maintain a AAA through Fitch Ratings. Outside the European Union, Canada, Australia, Singapore, Switzerland, Norway, and the United States still enjoy AAA, though there have been some downgrades from Moody's and S&P Ratings recently. In early 2009 my feeling was that Swiss and Norwegian companies would fair better than other companies, and that formed the basis of my investment research at that time. Looking forward many more years, I feel we may see more economic improvement in Asia, though not through A+ rated China. Even with Australia still a good investment direction, the economy is very much tied to infrastructure spending in China, and the continued exports of raw materials to China. We now see some slowing in business activity in Australia, which may indicate some slowing in the near term. Many individual southeast Asia countries should be viewed as frontier economies, though we may soon see a few emerging market investment opportunities there. One country that is poised at the hub of trade in southeast Asia is Singapore, the location of one of the largest shipping ports in the world. Singapore operate a sovereign wealth fund and a stringent monetary authority. Despite that Singapore does not need to issue bonds, doing so helps the credit ratings of companies in Singapore. M&G investments has a great report and video on Singapore. We will be researching southeast Asian investment opportunities, and some west African frontier investment opportunities through early 2013. My feeling is that these frontier economies, with large mobile workforces, largely untapped natural resources, and open trade routes, may become the next long term investment opportunity.

The S&P 500 has continued to languish as various politicians release statements about Fiscal Cliff negotiations. Despite extensive news coverage, there is still no concrete deal in place. It appears that negotiations will go down to the self-imposed 21 December 2012 deadline, though we may see some last minute changes prior to the end of the year. At the moment market participants seem cautiously optimistic that some form of a deal will be put together prior to 21 December. Tuesday 11 December saw a slight early rally in the S&P 500 as investors expected some statement out of the Federal Open Markets Committee (FOMC) meeting and Federal Reserve Chairman Ben Bernanke. Gold futures remained largely unchanged ahead of an FOMC announcement. On 12 December the Federal Reserve released their latest Monetary Policy statement. One item of interest was whether the Federal Reserve would officially replace Operation Twist, which is set to expire on 31 December 2012. Operation Twist involves the purchases of long term US Treasuries, and the sale of shorter term US Treasuries. The Federal Reserve announced that starting in January 2013, they will begin a new round of $45 billion in open market bond purchases, and continue purchasing up to $40 billion per month of Mortgage Backed Securities (MBS). The new round of bond purchases will add to the estimated $1.65 trillion in previous bond purchases, making the Federal Reserve one of the largest holders of US debt. The worry in this is that the Federal Reserve is distorting the bond market. The WallStreet Journal has a great project tracking Federal Reserve statements, for those more interested in the nuances of change in monetary policy. The major changes of note are the target 2.5% inflation rate, and targeting 6.5% unemployment. The last time the unemployment rate was 6.5% was in September 2008. While the Fed acknowledges that the economy is expanding at a "moderate pace", they did not place a time limit upon the newest round of asset purchases. Historically bonds are a safe haven investment decision, but with continued monetizing of U.S. debt, investors may want to limit their exposure to US Treasuries for the next few years.

The idea behind the Federal Reserve action, especially with purchases of MBS, is that the additional stimulus will drive demand for housing and mortgages, and spur job growth. The expectation is that banks will initiate more mortgages, and bundle those new mortgages in new MBS, since they have at least one ready buyer with the Federal Reserve. There are numerous issues with this idea, though one notable barrier is that many of the largest banks are facing lawsuits over MBS issued during the housing bubble. The major banks are much more cautious initiating new mortgages, and the slow pace of economic improvement, including a persistently high unemployment rate, are hindering a greater recovery in housing. We may see some improvement through 2013, though housing gains may be limited by the decline in unemployment. Weekly jobless claims did decline slightly to 343k against an expectation of 372k claims. Part of the decline may be due to expanded holiday hiring, with retailers adding the most seasonal workers since 2000. With consumer confidence levels low, it remains to be seen whether the holiday shopping season will be more active than in the last several years. The US trade deficit declined to $42.24 billion against an expected $46.6B, though it is notable that both imports and exports declined to the lowest levels since April. Retail sales will be one very important economic indicator, though any improvement there may be tempered by Fiscal Cliff negotiations. So for now we await 21 December, and some news of a resolution to Fiscal Cliff negotiations.

G. Moat

The S&P 500 has continued to languish as various politicians release statements about Fiscal Cliff negotiations. Despite extensive news coverage, there is still no concrete deal in place. It appears that negotiations will go down to the self-imposed 21 December 2012 deadline, though we may see some last minute changes prior to the end of the year. At the moment market participants seem cautiously optimistic that some form of a deal will be put together prior to 21 December. Tuesday 11 December saw a slight early rally in the S&P 500 as investors expected some statement out of the Federal Open Markets Committee (FOMC) meeting and Federal Reserve Chairman Ben Bernanke. Gold futures remained largely unchanged ahead of an FOMC announcement. On 12 December the Federal Reserve released their latest Monetary Policy statement. One item of interest was whether the Federal Reserve would officially replace Operation Twist, which is set to expire on 31 December 2012. Operation Twist involves the purchases of long term US Treasuries, and the sale of shorter term US Treasuries. The Federal Reserve announced that starting in January 2013, they will begin a new round of $45 billion in open market bond purchases, and continue purchasing up to $40 billion per month of Mortgage Backed Securities (MBS). The new round of bond purchases will add to the estimated $1.65 trillion in previous bond purchases, making the Federal Reserve one of the largest holders of US debt. The worry in this is that the Federal Reserve is distorting the bond market. The WallStreet Journal has a great project tracking Federal Reserve statements, for those more interested in the nuances of change in monetary policy. The major changes of note are the target 2.5% inflation rate, and targeting 6.5% unemployment. The last time the unemployment rate was 6.5% was in September 2008. While the Fed acknowledges that the economy is expanding at a "moderate pace", they did not place a time limit upon the newest round of asset purchases. Historically bonds are a safe haven investment decision, but with continued monetizing of U.S. debt, investors may want to limit their exposure to US Treasuries for the next few years.

The idea behind the Federal Reserve action, especially with purchases of MBS, is that the additional stimulus will drive demand for housing and mortgages, and spur job growth. The expectation is that banks will initiate more mortgages, and bundle those new mortgages in new MBS, since they have at least one ready buyer with the Federal Reserve. There are numerous issues with this idea, though one notable barrier is that many of the largest banks are facing lawsuits over MBS issued during the housing bubble. The major banks are much more cautious initiating new mortgages, and the slow pace of economic improvement, including a persistently high unemployment rate, are hindering a greater recovery in housing. We may see some improvement through 2013, though housing gains may be limited by the decline in unemployment. Weekly jobless claims did decline slightly to 343k against an expectation of 372k claims. Part of the decline may be due to expanded holiday hiring, with retailers adding the most seasonal workers since 2000. With consumer confidence levels low, it remains to be seen whether the holiday shopping season will be more active than in the last several years. The US trade deficit declined to $42.24 billion against an expected $46.6B, though it is notable that both imports and exports declined to the lowest levels since April. Retail sales will be one very important economic indicator, though any improvement there may be tempered by Fiscal Cliff negotiations. So for now we await 21 December, and some news of a resolution to Fiscal Cliff negotiations.

G. Moat

After one of the longest episodes of can kicking in history, the Eurogroup decided to kick the can even further down the road for Greece. Further assistance for Greece has been approved, though releasing funds is still subject to conditions being met by Greece. This issue has been a major drag on financial markets for over two years. A failure in Greece was speculated to lead to a failure in Spain, Portugal, and Italy, which some analysts felt would lead to a break-up of the Euro, and a return to old currencies. A few studies seem to suggest a financially stable country, such as Finland, could willingly leave the Euro, though at the moment that appears to be very unlikely. While there are still many details to resolve, the more immediate issue of the collapse of the financial system in Greece has been pushed ahead a few years. I'm not convinced the growth projections and turn-around prospects are realistic, especially given the culture of tax evasion, corruption, and cronyism in Greece. The Greek news daily Ekathimerini ran the full Eurogroup statement without comment. The big items in the deal made for Greece involve a relaxing of the previous fiscal targets and lowering the debt-to-GDP target amounts, while extending the time period for recovery. As noted in our previous articles, an extension of time for Greece will be a drag on Europe, as more funds will be needed over a longer time period. Greece will receive up to €43.7 billion (Euros) in several stages, with the first instalment set for 13 December 2012. Reviews will happen quarterly, as long as Greece can maintain repayment schedules for previous bail-outs. Part of the latest deal involves a buy-back of Greek debt at a fraction of the previous value, which is supposedly voluntary to avoid triggering a technical default. The details of how the Greek debt buy-back will function have yet to be released.

The Euro gained following the announcements on Greece, and most major European stock markets moved upwards to new 2012 highs. If you hold shares in European companies, you may have seen some gains recently. It may be tempting to think that with the Greek debt issues resolved, markets can now move to more realistically reflect economic conditions. However, the Greek story will continue to come back into focus every few months for many more years, especially if the political balance shifts in Greece towards an anti-bailout emphasis. The current group in power in Greece ran on the promise of renegotiating debt conditions, though they barely achieved any of the concessions the politicians promised the public. I think it is far too early to claim that a bottom has been reached in European markets, and I would expect some pullback in early 2013. Greek debt-to-GDP will still be 124% by 2020, and even that may be a wildly optimistic target. Politicians in Europe may imagine they are avoiding problems in bond markets for Spain and Italy, though throwing money at Greece and expecting a 65% improvement in the Greek economy by 2020 does not seem rational. While Greece gets some relief in 2013, there are still major changes needed to their economy to get back on track towards growth. The debt buy-back will be a key aspect of the 2013 turn-around. Fitch Ratings stated that the debt buy-back is not a credit event, meaning it should not trigger sovereign Credit Default Swaps (CDS) on Greece, though this only applies if the debt buy-back is voluntary. Moody's Ratings downgraded the credit rating of the European Stability Mechanism (ESM) and the European Financial Stability Facility (EFSF) largely on funding concerns from France, whom Moody's recently downgraded; though another issue is that the ESM and EFSF funds may be used to provide funding for the Greek debt buy-back. Matina Stevis of the WallStreet Journal has a great article about the Greek debt buy-back. She points out that €9.6 billion (Euros) in funding will be needed to entice private Greek bond holders to sell back their bonds at a loss. The sticking point in this is that there is no provision in the bail-out package to provide €9.6 billion in funds. Some analysts think this funding may come through the EFSF. Supposedly if the debt buy-back does not go smoothly, there is a Plan B, though so far no Eurogroup officials have provided any details. Early indications are that participation in the debt buy-back may be greater than expected, though investors must make clear their interest before 7 December 2012, and the final details will be revealed 17 December 2012.

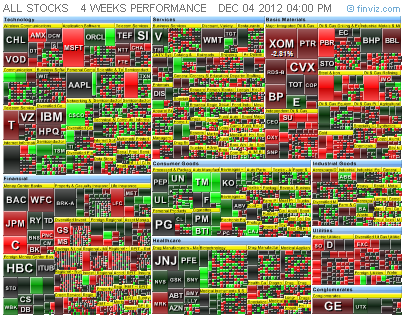

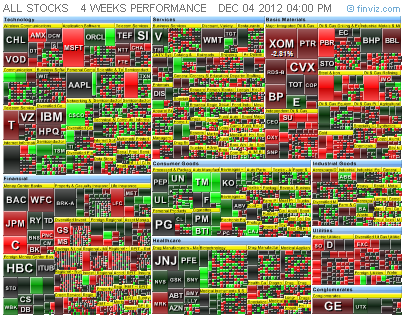

During the month of November, the S&P 500 opened at 1412.20, and finished the month at 1416.18, trading in a range from an early month high of 1434.27 and a mid month low of 1343.35. Continued low trading volume made for some interesting moves, though essentially markets failed to rally. Most investors could have ignored this month and probably came out at about the same level in which they started. Obviously concerns surrounding the U.S. elections, and some global concern over a change of leadership in China, kept some institutional investors out of the markets, which contributed to the low trading volumes. Some of the large investment companies in the market, like Paulson & Company and Soros Fund Management, released 13-F filings that indicated they increased their holdings in gold ETFs and gold futures over the previous quarter. Oddly enough, the recent declines in gold futures are rumoured to be due to Paulson & Company unloading gold positions to meet client redemption requests. Warren Buffett hired two new fund managers forBerkshire Hathaway (BRK.A) and their recent 13-F filing with the SEC (Securities and Exchange Commission) indicated new positions in Deere (DE) and Precision Cast Parts (PCP). It is important to remember that 13-F filings show past activity. A large investor decreasing positions in some companies may not necessarily be a cause for concern, nor should purchase activity be an indication to buy shares in a company. You can find the latest complete SEC 13-F filings at the following links for Berkshire Hathaway, Tudor Investments, Soros Funds, Third Point LLC, and Appaloosa Management. We might get a false sense of optimism after viewing the holdings, though most of these large funds tend to hold shares for long periods of time. It is more common to find pessimism amongst smaller investors, often due to uncertainty. While there is nothing wrong with being a cautious investor, it is good to avoid the doomer mentality as defined by Bill McBride of Calculated Risk. McBride points out that in 1994 Larry Kudlow (of financial news network CNBC) predicted that Clinton tax increases would lead to a severe recession, or even a depression, though we now know that prediction was wrong. Business Insider recently interviewed Bill McBride, and pointed out several of McBride's correct predictions over the years, including the bottom of the housing market in March 2012.